japan corporate tax rate pwc

The articles of the Corporate Tax Law CTL and CTL Enforcement Ordinance CTLEO were revised to agree with the updated Article 5 of the OECD MTC. Worldwide Tax Summaries cuts through those complexities.

The business environment for Japanese companies has changed drastically driven in part by globalization BEPS the introduction of the Corporate Governance Code requiring the.

. Branch profits are taxed in the same manner as corporate profits. The consolidated national corporate income tax liability is determined by applying the corporate income tax rate to the consolidated taxable income and adjusted for consolidated. 151 rows 34 composed of IRPJ at the rate of 25 and CSLL at the rate of 9.

Provincial and territorial CITs range from 8 to 16 and are not deductible for federal CIT. This useful online tool will help you make informed decisions with the most up-to-date and relevant details about tax systems in. As a leading firm in the tax industry we continue to pursue the No.

The Corporate Tax Rate in Japan stands at 3062 percent. Abolishment of consolidated tax system and. Corporate - Branch income.

Detailed analysis of the 2020 Tax Proposals will be provided in a subsequent Japan Tax Update. The revised definition of PE. Corporate Tax Rate in Japan averaged 4049 percent from 1993 until 2022 reaching an all time high of 5240 percent in 1994 and a.

PwC Tax Japan is the firm that. New Rules Allow Japanese Tax Authorities to Unilaterally Appoint Local Tax Administrator of Foreign Taxpayer. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties.

Information on corporateindividual tax ratesrules in 150 countries. Manage the global structural tax rate. A combination of changes published in the latest Japanese tax reform on 8 December 2016 and the upcoming decrease in UK corporate tax rate to 19 could mean the Japanese Controlled.

Our knowledgeable teams help many companies to conform to the latest. Last reviewed - 08 August 2022. However the family corporation tax does not apply to.

In addition to tax compliance services our tax professionals are. Formulate effective and tax-efficient cross-border strategies for both Japanese and overseas investments. The map below shows very clearly that the cantons of Berne Zurich and Ticino have.

Our tax professionals can assist companies. Effective tax rates are displayed Corporate tax rates were cut in 12 cantons compared to 2021. 1 Client Friendly Tax Advisor.

Asia Pacific Tax Insights app. Asia Pacific tax and business insights all in one hand. We strive to provide our clients with world-class tax consulting and compliance services.

The PwC Japan group includes PwC Aarata PricewaterhouseCoopers Kyoto PricewaterhouseCoopers Co Ltd PwC Tax Japan PwC Legal Japan and their subsidiaries. On 26 March 2021 as a part of Japans 2021 Tax Reform.

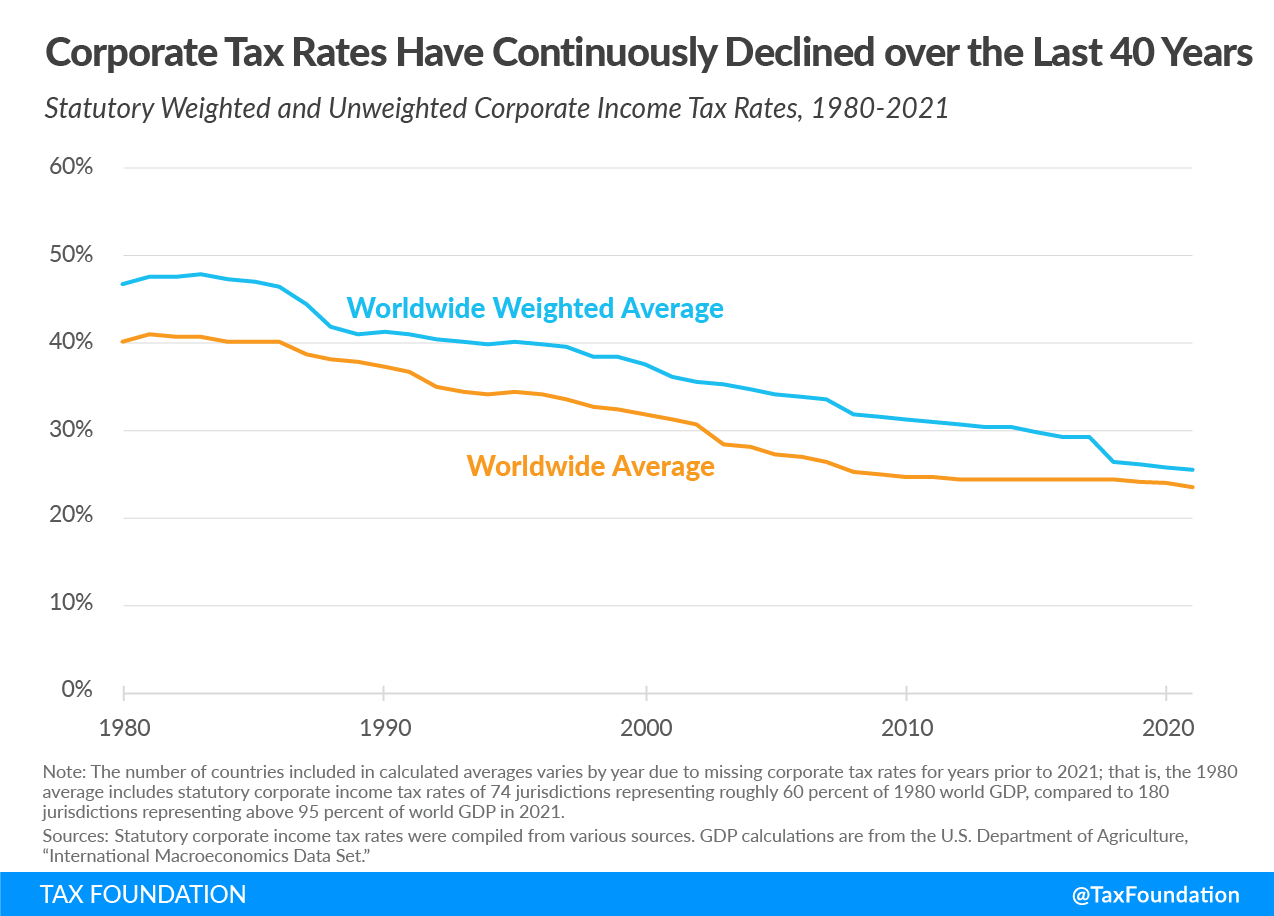

Corporate Tax Rates Around The World Tax Foundation

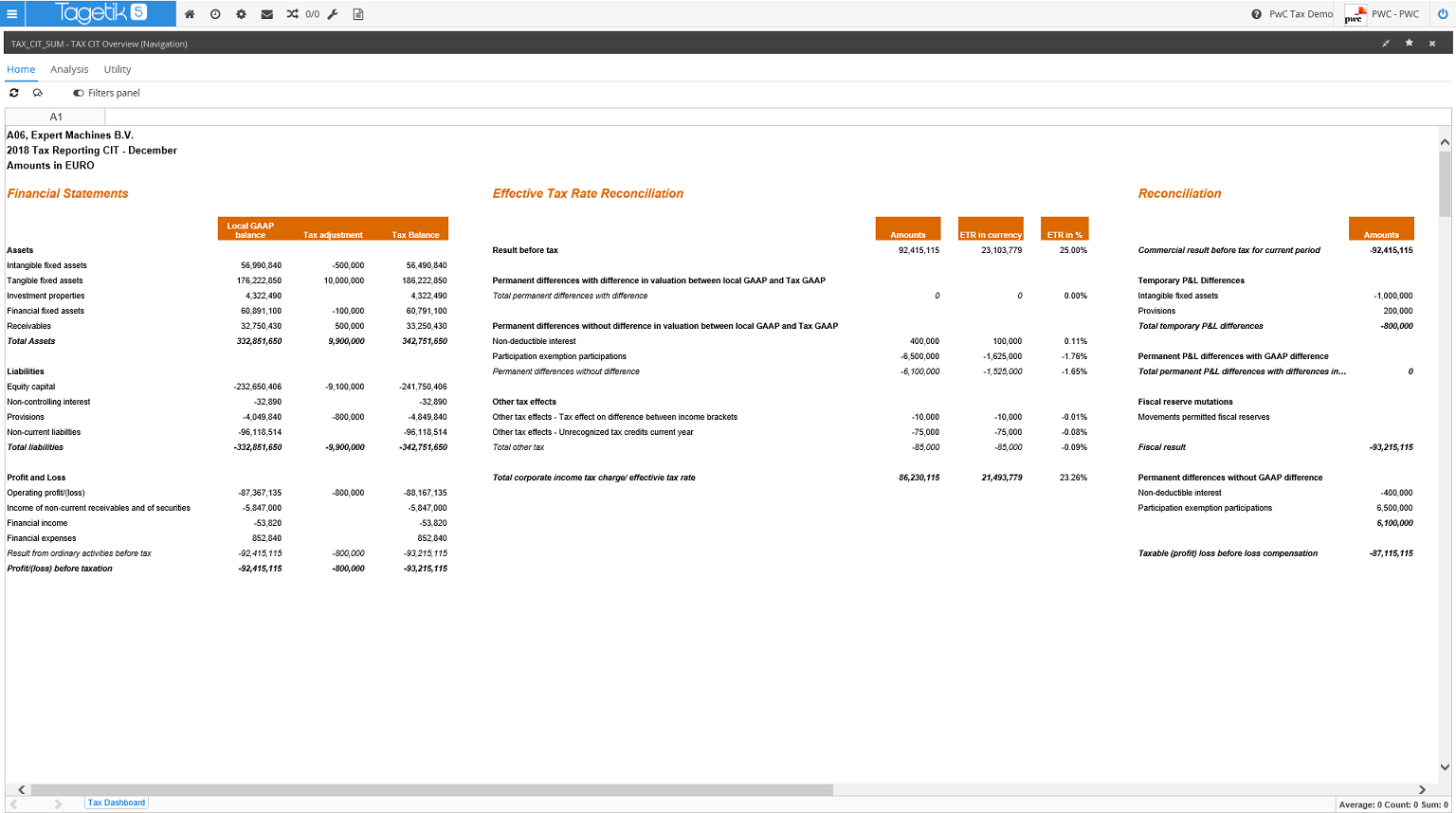

Tax Reporting Strategy Tax Services Pwc

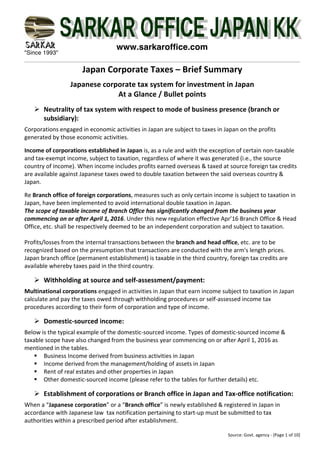

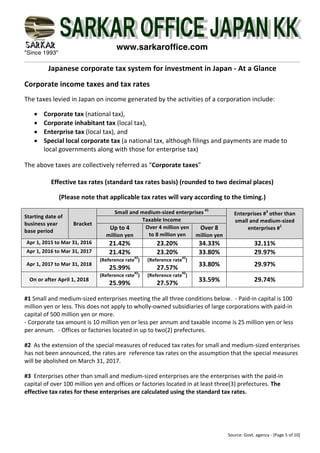

Japanese Corporate Tax At A Glance In Bullet Points

Changes In Corporate Effective Tax Rates During Three Decades In Japan Sciencedirect

The European Commission S War Against Pro Growth Corporate Tax Policy Cato At Liberty Blog

Corporate Tax Rates Around The World Tax Foundation

Pwc Japan Group Japan Firm Profile Itr World Tax

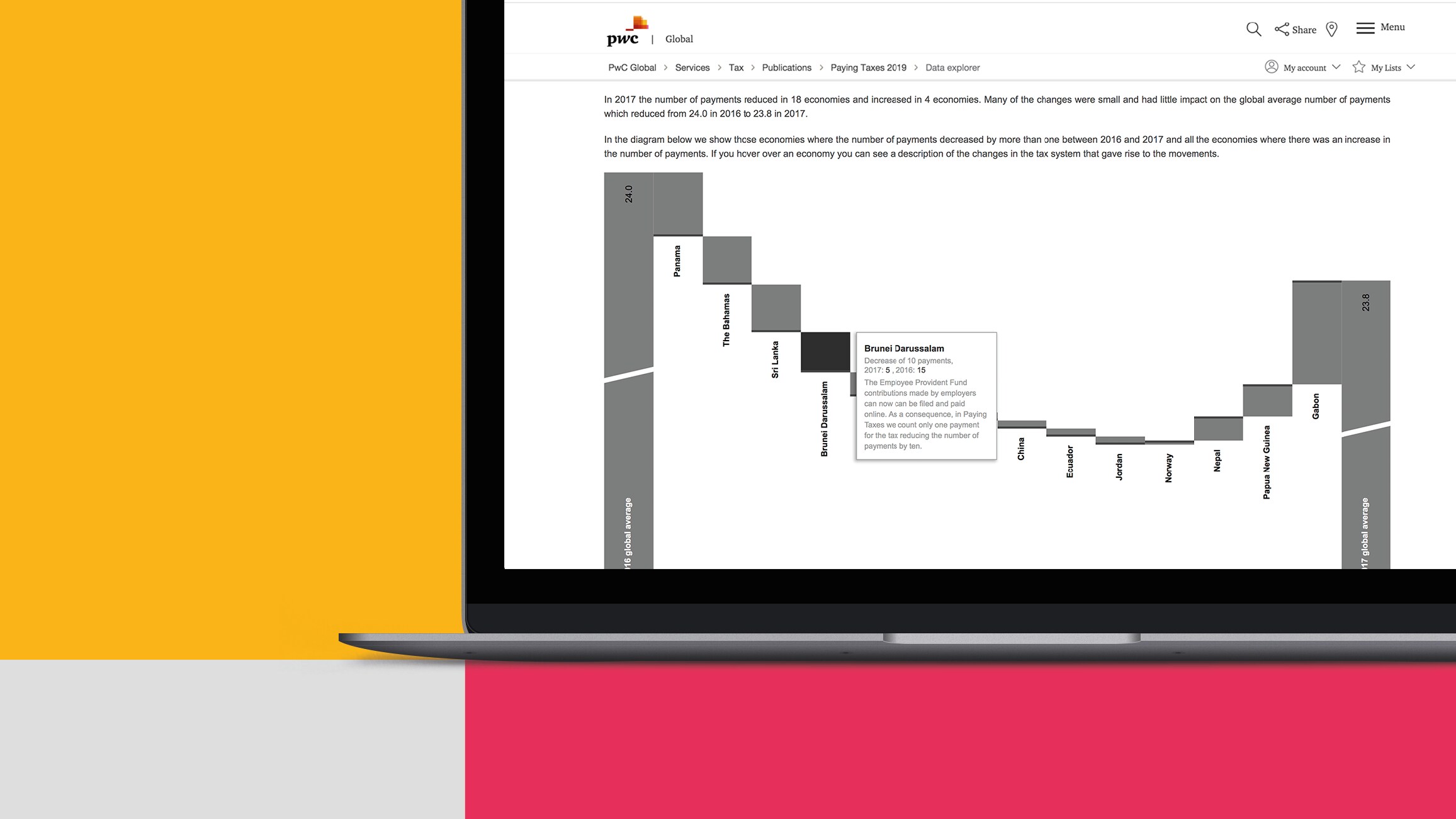

Paying Taxes 2020 In Depth Analysis On Tax Systems In 190 Economies Pwc

Support For Transfer Pricing Tax Audits Pwc Japan Group

Japanese Corporate Tax At A Glance In Bullet Points

Japan Further Discusses Lowering Their Corporate Rate Tax Foundation

Tax Provision And Reporting Solution By Pwc Wolters Kluwer

Paying Taxes 2020 Overall Ranking And Data Tables Pwc

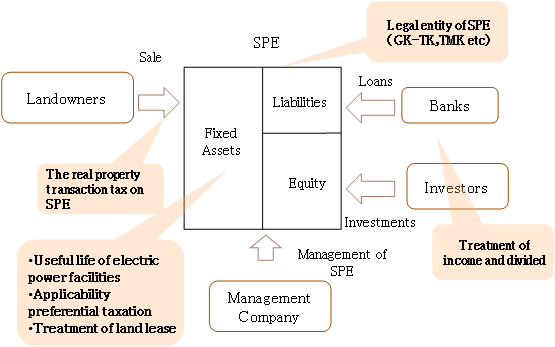

Tax Issues On Operation And Investments In Renewable Energy Business Pwc Japan Pwc Japan Group