how much will my credit score increase with a car loan

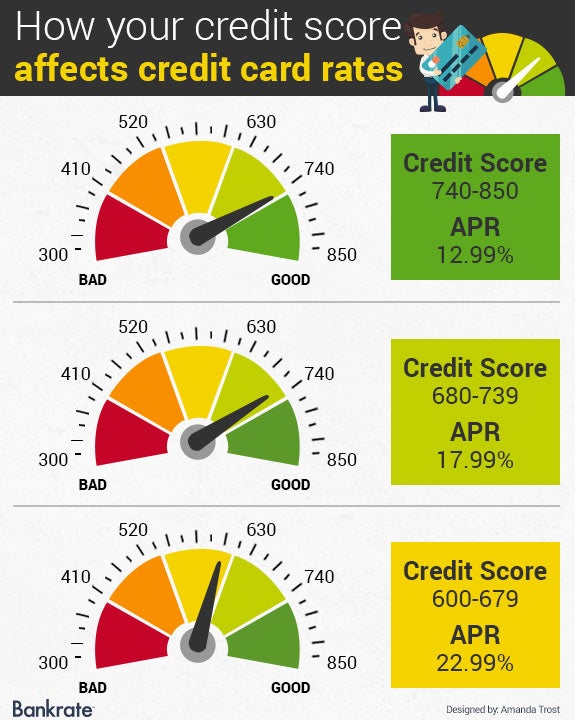

1 day agoIf a prime rate increase causes your loans interest rate to go up expect a higher monthly payment amount as a result. The APR term and loan amount may all change depending on your credit score.

In a nutshell the FICO credit scoring formula the most commonly used scoring.

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

. If you already have a credit score in. Apply Drive Today. Ad Quick Decisions Low Rates Easy Application.

Here is how its calculated. But if paying off a car loan decreases your average account age. Your score will increase as it satisfies all of the factors the.

The good news is financing a car will build credit. Start with a MoneyLion Credit Builder. If I have a 20000 limit and Im using 15000 of it my credit utilization is at a high 75 percent.

Each credit report the auto loan lender pull adds 1 new hard inquiry and each hard inquiry lowers your score up to 10 FICO points. Learn More. Paying off a car loan can allow more breathing space by reducing your.

Heres a look at whats a bad credit score according to a widely used version of the FICO credit scoring models. Those with lower credit scores will generally be required to. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer.

In the event of a financial setback refinancing will reduce monthly auto loan payments. In most cases the higher your credit card utilization ratios the lower your credit scores will be. Experts have stated that your credit score will begin to improve within just a few months after paying off your car loan.

Youre not alonemany people with car loans question when to pay it off. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit. If you make payments on time your credit score will grow.

However its normally temporary if your credit history is in decent shape it bounces back. There are five factors that. Ad If you have bad credit no credit bankruptcies or even repos were the answer.

It doesnt matter how bad your credit history is we look at your potential to repay. We took a 41000 loan and placed both myself and my wife on the title and the loan. Ad See Your Free Credit Score and Get Critical Alerts with Chase Credit Journey.

Throughout your life you build a credit score which can change over time. Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders. For example a buyer with a 750 FICO score may qualify.

Those with lower credit scores will be faced with higher interest rates. Low scores create capped amounts and durations. Once you pay off a car loan you may actually see a small drop in your credit score.

Granted this method will make the auto loan drag on. Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan. How long after paying off a car loan does credit improve.

Depending on your credit score which dictates your. To determine the initial interest rate for your loan your. Your credit score may also affect your down payment amount.

If a payment is late its recorded as 30 60 90 or 120 days late. Most of us 84 rely on financing when purchasing a vehicle according to data from Experian Automotive fourth quarter 2014 and the average loan amount for a new. Its best to pay a credit card balance in full because credit card companies charge interest when you dont pay your bill in full every month.

As you make on-time loan payments an auto loan will improve your credit score. The credit application you fill out for a car loan can temporarily lower your credit score usually by fewer than five points according to the MyFICO website. Need help establishing or rebuild your credit score.

When you make payments on time it. When FICO calculates scores on a scale from 300 to 850 points it. However your credit score will prevent you from borrowing money if your score is low.

For example if paying off a car loan bumps your average account age from four to six it could boost your score. To understand the overall impact of a car loan its important to understand the anatomy of a credit score. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer.

A single car loan application could lower your score up to 30. How much your credit score will increase is determined by your starting point. Ad All Requests Accepted New or Used Car Immediate Response.

Your payment history makes up a very large portion of your credit mix. Nonetheless I hope our situation can still serve as a proof-of-concept for others out there. Lenders usually decide upon loan approval based on your credit score.

Answered on Dec 15 2021.

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

What S The Minimum Credit Score For A Car Loan Credit Karma

What S The Minimum Credit Score For A Car Loan Credit Karma

Credit Score Your Number Determines Your Cost To Borrow

How Do I Qualify For A Car Loan Experian

Credit Score Needed To Buy A Car In 2021 Lexington Law

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

How Fast Will A Car Loan Raise My Credit Score Plus The Secret To Rate Shopping

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair

What Is A Good Credit Score Forbes Advisor

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

Average Auto Loan Interest Rates Facts Figures Valuepenguin

How Do Car Loans Affect Your Credit Score Shift

Does Financing A Car Build Credit

Auto Loan Rates By Credit Score Experian

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

How To Get A Car Loan With No Credit History Lendingtree

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)